- October 13, 2020

- Posted by: Author One

- Category: Uncategorized

Because of the thriving software and technology market nearby, the area’s housing prices have grown rapidly to match rising incomes in that particular sector. If you are part of the tech industry, you’ll love Fremont and enjoy the weather. But if you have a normal job under $80,000 per year, it may not be the best choice. You’ll have a hard time finding viable real estate in Fremont that doesn’t go for at least $800,000 to $1 million.

- This huge gap in livable versus minimum wage signals how unaffordable Fremont can be for the average person.

- In many cases these local sales taxes can have a profound impact on the total rate that consumers pay.

- However, part of the city is in Sarpy County and is subject to a total rate of 5.5 percent.

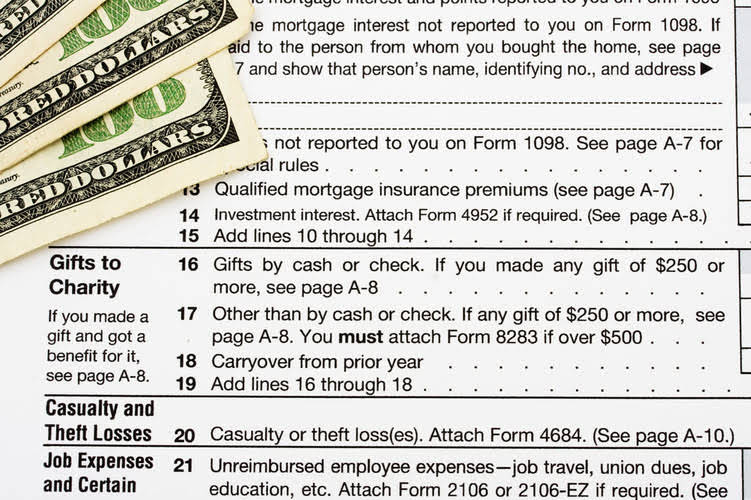

- Through Measure C, the county sought to authorize an additional 0.5 percent sales tax for 20 years to raise money for the Children’s Health and Child Care for Alameda County Fund.

- Central Virginia, Northern Virginia, and Hampton Roads, Virginia have an additional 0.7 percent rate for transportation districts, which is treated here as a local tax.

- 4 Glendale, California, which also levies a 10.25 percent combined rate, was featured in our previous report, but the city’s population has dipped below 200,000 in the latest Census update.

Sales Tax Bases: The Other Half of the Equation

The average monthly rent for an apartment in Fremont, however, is a staggering $2,470. Homeownership in Fremont, California is only accessible to the wealthy, especially considering the housing index is 247 points higher than the rest of the state. This is certainly concerning since California is already an expensive place to live. The median cost of a home in California is $552,800, which is around half the median home price in Fremont.

Sales Tax Calculator of 94538, Fremont for 2024

Please use and/or share my information with a Coldwell Banker agent to contact me about my real estate needs. Please check the input address or click here to submit a request with the address information you provided to determine the correct rate. No warranty is made as to the accuracy of information provided. Sales Tax States shall in no case be held responsible for problems related to the use of data and calculators provided on this website.

Fremont Valley ZIP codes

Though, only a quarter of the cities in the state have this rate, as each local government can impose their own taxes on top of that. With the additional county and city sales tax rate of 2.0%, this brings the total sales tax rate in Fremont, California to 9.25%. Sales taxes in the United States are levied not only by state governments but also by city, county, tribal, and special district governments. In many cases these local sales taxes can have a profound impact on the total rate that consumers pay.

Fremont doesn’t look any more favorable when you consider the cost to rent. Nearly $2,000 for a studio apartment is double what it will cost you in other areas of the U.S. This will make it challenging for young fremont tax rate professionals and families to join the Fremont community. There’s no question that roommates or significant others are an absolute necessity to lower the rent burden. The livable wage in Alameda County (where Fremont is located) amounts to about $21.88 per hour for a single adult.

Estimate the Cost for 427 School St

(f) Most of Aurora is in Araphoe County and is subject to an 8.0 percent sales tax. However, parts of the city are https://x.com/BooksTimeInc in Adams and Douglas Counties and are subject to 8.5 and 8.75 percent rates respectively. (d) Most of Kansas City is in Jackson and Platte Counties and is subject to an 8.85 percent sales tax. However, part of the city is in Clay County and is subject to a total rate of 8.725 percent. (c) Most of Atlanta is in Fulton and DeKalb Counties and is subject to an 8.9 percent sales tax.

(e) Most of Oklahoma City is in Oklahoma County and is subject to an 8.625 percent sale tax. However, part of the city is in Cleveland County and is subject to a total rate of 8.875 percent. High housing prices for basic family homes will make it difficult for the average buyer to enter the market, so think twice about moving to Fremont unless you can rake in big money.

Who Needs a Sales Permit in Fremont City?

Operating in the state of New York as GR Affinity, LLC in lieu of the legal name Guaranteed Rate Affinity, LLC. This is a carousel with tiles that activate property listing cards. Fremont, CA is blessed with great weather, tons of entertainment and culture options, and hundreds of excellent jobs for motivated tech workers. If you have what it takes to hack it in the competitive tech field, Fremont could be a good place to call home.

On average, to https://www.bookstime.com/ live comfortably in Fremont as a single adult with no children you will need to make at least $47,590 a year. The state of California has a progressive income tax system, meaning the rate you pay is based on how much you earn. There are ten income tax brackets in total, reaching as high as 13.3% for earners making more than $1 million.